The latest report from the Labor Department indicates that annual inflation in the United States eased last month but remained high, underscoring the persistent impact of pandemic-related price surges.

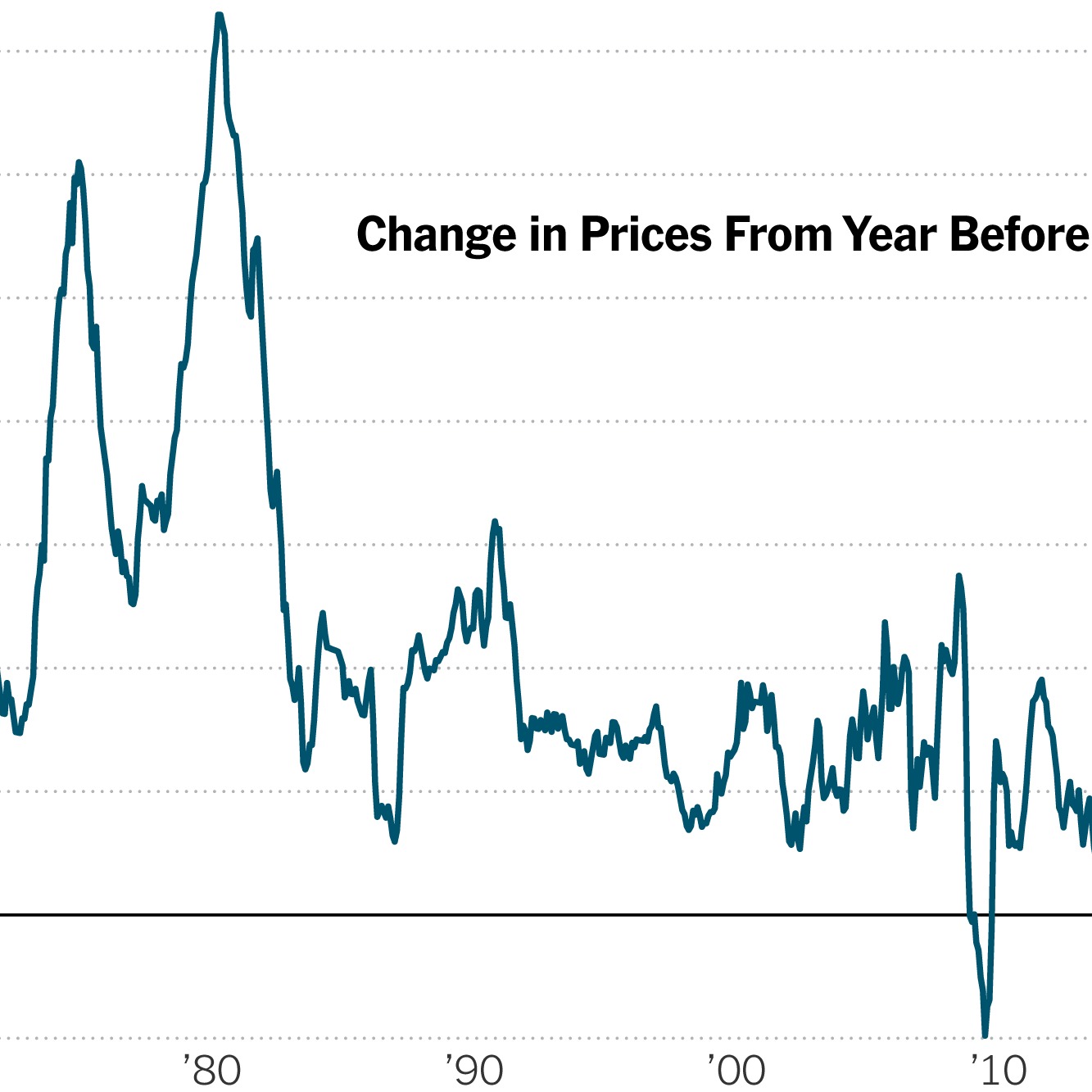

According to the Consumer Price Index (CPI), prices rose by 0.3 percent from December to January, slightly higher than the 0.2 percent increase in the previous month. Over the past 12 months, prices have surged by 3.1 percent.

Although this is a decrease from the 3.4 percent figure recorded in December and significantly lower than the peak of 9.1 percent in mid-2022, it remains above the Federal Reserve’s target level of 2 percent.

Inflation Rate in US Assumed To Decreases (Credits: The New York Times)

Inflation has become a crucial issue in President Joe Biden’s re-election bid, as public frustration continues. Excluding volatile food and energy categories, core prices rose by 0.4 percent last month, up from 0.3 percent in December, and increased by 3.9 percent over the past year.

Officials from the Biden administration point out that inflation has declined since the height of pandemic-related disruptions and government aid. Forward-looking data suggests a continued cooling of inflation.

However, despite nearing the Fed’s target level, many Americans are frustrated with prices remaining approximately 19 percent higher than when Biden took office.

The mixed data could reinforce the caution of Fed officials, who want further evidence before confidently concluding that inflation is sustainably headed back to their 2 percent target.

The central bank is expected to wait until May or June to begin cutting its benchmark rate from its 22-year-high of around 5.4 percent.

Fed Chair Jerome Powell highlighted that most of the decline in inflation so far has been due to lower prices for goods, while the costs of services, such as auto repairs, health care, and entertainment, are still rising.

A rate cut by the central bank could lower borrowing costs for consumers and businesses, potentially bolstering the economy.

However, stronger economic growth could also pose challenges, accelerating wages and consumer spending, potentially worsening inflation if businesses struggle to keep up with increased demand.

Signs indicate that the economy remains healthy in 2024, with increased hiring, rising new orders in manufacturing, and an uptick in sales reported by services companies.