Americans have a clear notion of the amount required for a comfortable retirement, yet the reality of their savings falls short of this target.

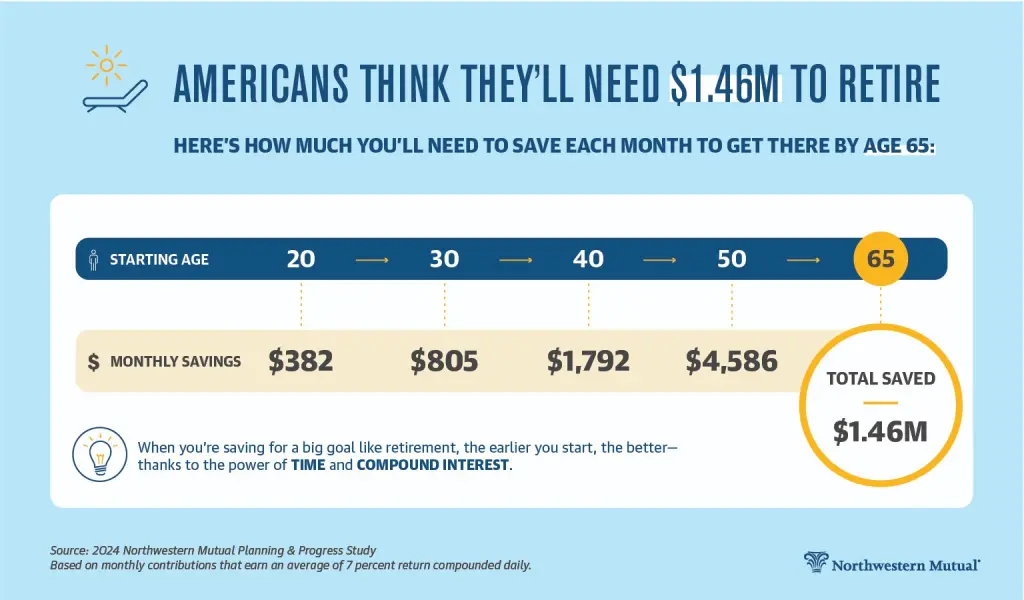

A recent study revealed that many Americans believe they should have approximately $1.46 million set aside to retire comfortably. However, statistics paint a different picture: the average American has less than $89,000 saved for retirement, according to a study released this week by Northwestern Mutual.

With inflation eroding the value of their savings, Americans’ retirement plans are taking a significant hit.

Aditi Javeri Gokhal, head of institutional investments and president of retail investments at Northwestern Mutual, commented on this disparity, stating, “People’s ‘magic number’ to retire comfortably has exploded to an all-time high, and the gap between their goals and progress has never been wider. Inflation is expanding our expectations for retirement savings and is putting the pressure on the ability to plan and stay disciplined.”

Perception versus Reality: Americans’ Retirement Savings Discrepancy Revealed by Study (Credits :New York Post)

The perceived target of $1.46 million for retirement savings represents a 15% increase from last year’s projection of $1.27 million and a whopping 53% rise since 2020, surpassing current inflation rates.

According to Northwestern Mutual’s poll, individuals aged 50-59 estimate they need approximately $1.74 million saved for retirement, yet they have only accumulated $115.7k. Similarly, those aged 40-49 believe they need around $1.3 million saved, but in reality, they have just $91.5k stashed away.

However, despite the significance of retirement planning, a survey conducted in 2023 found that only 40% of “Gen X” workers are certain about the amount they need to retire, as reported by Bankrate.

In terms of retirement age, a 2016 poll by the US Census Bureau revealed that the average retirement age for women was 63 and for men was 65.

Recent rankings from WalletHub identified New York and New Jersey as among the worst states to retire in, with New York City ranked at No. 7 and New Jersey coming in at No. 2 in terms of the least desirable states for retirement.

This ranking, based on factors such as affordability, quality of life, and healthcare, highlighted the challenges faced by retirees in these states. With a cost of living 27% higher than the national average and housing costs soaring 80% above the national average, New York presents significant financial hurdles for retirees. Additionally, healthcare services in the state are 7% more expensive than the national average, according to data from RentCafe.